Role of Insurance Sector in Economic Development of a Nation, Article of Prajwal Bikram Thapa

- Prajwal Bikram Thapa

- 2024 Apr 29 21:06

Kathmandu. The need and use of insurance in the business world is increasing day by day. Potential losses that may arise from the risks faced due to uncertainty in human and business life can be minimized through insurance.

The world we live in is full of contingencies and risks. While it is always not possible to prevent such uncertain events from occurring, there is a mechanism to protect ourselves against the unpredictable losses. Insurance safeguards life, wealth and assets of individuals by spreading the risk among large number of premium payers. Insurance is simply known as the transfer of risk from individual to the insurance industries in lieu of a premium amount.

Not only insurance indemnifies the individuals and business entities but also it plays an instrumental role in the economic development of a nation by employment creation, providing stability to functioning of business, investing in business ventures, all of which ultimately encourages savings and capital formation. This sector can play a significance role in financial mobility, economic growth and development.

Life insurance and non-life insurance are the two wings of insurance industries. Life insurers have been selling various products of life policy, money back plans, endowment policy, accident and health related policies, children insurance plans and policies etc., whereas nonlife insurers are selling various products like fire insurance, health and medical insurance, marine insurance, group accidental insurance, aviation insurance and miscellaneous insurance.

Insurance industries can use their funds consisting of premiums, reserves and capital to financial claim payments and other expenses. Insurance is a way to minimize and provide protection against those risks which are beyond human control. It is a way to indemnify to those unpredictable losses. Thus, insurance is transfer of the risk of loss from one entity to another in exchange for a premium and can be taken as a guaranteed compensation of a probable loss.

M. Subba Rao, R. S. (2013) pointed that the insurance sector boosts economic growth by promoting financial stability, mobilizing and channelizing savings, supporting trade, commerce, entrepreneurial activity and social programs; and encouraging the accumulation of new capital and fostering a more efficient allocation. Moreover, the sector reduces the amount of capital needed to cover these losses individually, thereby encouraging additional output, investment, innovation, and competition. Insurance companies have long investment horizons and can contribute to the provision of long-term finance and more effective risk management. The main goal of insurance is protecting life, wealth and assets of the human being. Insurance companies play especially great role in economy.

Insurance activities also help increasing the saving which helps to capital formation and ultimately leads to increasing country GDP. On the other side, insurance increases employment in economy. Improve economic and financial stability also one of the main advantages of insurance. Current Scenario of Insurance Sector in Nepal Insurance is one of the major components of financial system of Nepal. As a Nepalese financial system, the share of insurance sector is second largest behind bank and financial institutions. As a risk transfer mechanism, insurance provides financial protection from unpredictable losses.

The increasing number of insurance companies is the evidence that insurance sector is becoming more essential for the economic development of a nation. The cumulative impact of the global recession, the COVID-19 pandemic, and the war between Russia and Ukraine resulted in a 16.48% increase in insurance gross premiums, which led insurance sector to contribute 3.67 percent of the GDP for the fiscal year 2021–2022.

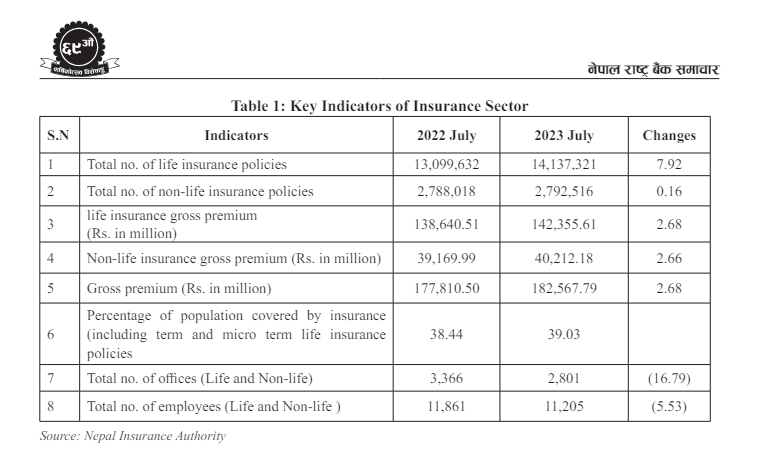

There are altogether 37 (14 Life insurance, 14 Non-Life Insurance, 2 Reinsurance and 7 Micro Insurance) insurance companies as of March, 2024. Despite Covid-19 pandemic and economic crisis around the globe, there have been some positive sign of growth in insurance sector in recent past in Nepalese insurance sector. The total number of life insurance policies was 14,137,321 in the FY 2022/23 which shows 7.92% increment from previous fiscal year.

Likewise, the total number of non-life insurance policies was 2,792,516 in the FY 2022/23 which shows a nominal growth of 0.16% from previous fiscal year. There is also a slight increase of 2.68% in gross premium in the FY 2022/23. There has been a moderate growth in coverage of insurance in recent year. Percentage of population covered by life insurance have risen steadily over the years and reached 39.03 percent in FY 2022/23 from 38.44 percent in previous year.

From the present status, a conjecture can be drawn that insurance sector will become more significant in the economic development of a nation. However, the total number of offices has declined in the FY 2022/23 to 2,801 which is a 16.79% decrement from the previous fiscal year. Similarly, the total number of employees has also decreased in the fiscal year 2022/23 and reached 11205, which is 5.53% declination from the previous year.

Regulatory Arrangements The insurance industry is closely linked with macroeconomic factors, regulation and supervision, and the achievement of national development objectives, as well as the international trade regime. It is also a subject connected with the regular life of common people, so that a legally responsible body has been designated for its regulation and monitoring. For this, currently an organization called Nepal Insurance Authority is doing the work of regulation and supervision of this sector.

In order to make the insurance business transparent and reliable, various regulatory arrangements have been made by Insurance Board. Initiation has been made from Provision of licenses to operational issues, governance, internal control system, claim and settlement, asset management, etc. Such directives and instruction help to provide proper guidance to the insurance business and to provide awareness to the stakeholders.

In addition to this, a risk-based supervision system has been developed and implemented to monitor the overall work and effectiveness of the insurance companies. Role of Insurance Sector Insurance is an integral part of the economy, performing a variety of important functions for the efficient and effective development of economy.

So, it is not easy to explain the importance of insurance business in limited words. The general public, society, business community and the nation as a whole can get unlimited benefits from the development and promotion of this sector. Some of the major aspects are described below.

● Insurance is an integral part of broader financial system. The premiums collected from the policyholders result into generation of financial resources which are invested in diversified portfolios such as government securities, fixed deposits, stocks and real state. Investments in government securities can contribute to public projects and government funding while the investment in stocks and real estate can support the growth of private sectors. The generation of financial resources from insurance industry fuels the growth of economy by creating economic stimulus.

● Insurance sector provides employment opportunities to many individuals by direct or indirect means. Apart from employees directly working for insurance company, there are also many insurance agents and insurance surveyors who are the benefited stakeholders of insurance industry. There are 12,031 employees directly employed in the insurance sector while the number of insurance surveyor was tracked 1,240 in the fiscal year 2021-2022 in Nepal. A significant growth has been witnessed in the number of insurance agents as the number of agents reached 296,403 in the fiscal year 2021-2022. The increasing number of people employed in insurance industry will increase consumer spending, and ensure financial stability.

● Investment in ventures is unarguably one of the pre-requisites of robust economic development. Insurance allows individuals and businesses to focus in their entrepreneurial pursuit, knowing that they have a level of financial protection against uncertain circumstances. By acting as a risk transfer mechanism, insurance drives the courage of entrepreneurs required to explore new opportunities and contribute to the economic development of a nation. This, in turn channelizes the savings to long term investments in different productive sector which leads to overall growth and development of economy.

● The practice of setting aside a portion of regular income to pay premiums of insurance according to contract develops a saving habit. Not only insurance acts as a tool for financial protection but also insurance policies serve as a means to accumulate savings over time or channel funds into various investment avenues such as retirement plans. Thus, insurance industry fosters a conducive environment for savings and capital formation that provides necessary resources to invest in human capital, and infrastructure which helps to achieve sustained economic growth.

● Insurance generates significant impact on the economy by mobilizing domestic savings. It also helps to develop service, agriculture and industry sector of economy. The contribution of insurance premium to GDP ratio also increasing in later days. Insurance enables to mitigate loss, financial stability and promotes trade and commerce activities, those results into economic growth and development which ultimately helps in sustainable growth and development of an economy.

● Insurance also plays a crucial role in crisis management for both individuals and businesses. History has been testimony that insurance builds resilience for the economy against pandemics and natural disasters thus allowing businesses and individuals to recover quickly from such unforeseen challenges. Like business, individuals are exposed to various kinds of unforeseen challenges one of which is associated to health. Health and wellbeing of individuals and their family members is the biggest concern for most. Perhaps, medical insurance is undoubtedly one of the most demanded insurance products as the insured gets financial support in case of medical emergencies. By preventing catastrophic medical expenses that could otherwise lead to personal financial crises as medical treatment cost are exponentially rising, medical insurance enables a healthier and more economically productive population. Additionally, it contributes to the overall stability of the healthcare sector and reduces the reliance on public resources for emergency medical care.

● Agriculture which is an indispensable part of economy for many nations, comprises of various risks associated with weathers, pests, and diseases. Agriculture insurance acts as a mechanism of protection for farmers against such uncertainties thus encouraging the swift adoption of advanced agricultural practices and stabilizing the agricultural yields. The increasing risk of climate change and its possible implications on agriculture has made it more necessary for farmers to be insured. Furthermore, access to credit becomes easier for insured farmers as their reduced risk profile increases the likelihood of getting credit.

● Portion of insurance sector in Nepalese stock market is going up. Insurance sector provides capital market more productive. As institutional investors, insurance companies contribute to the development as well as functioning of a capital market. Insurance companies receive premiums and invest to the capital market, which gives more dynamic and vibrant the capital market.

● Though the future of Insurance sector is promising, it still faces a major challenge of low penetration rate as insurance is an unsought product. As per the report of Nepal Insurance Board, insurance penetration for life insurance was only 44.05% in the year 2023. The low penetration of insurance reflects the consumer ignorance towards the benefits of being insured. The ability of insurance companies to win the trust of general public is crucial for the growth of insurance industry. Nepal is prone to calamities such as earthquake due to its topography.

Thus, managing risks associated with such natural disasters, including assessing and pricing the risk while ensuring that the companies meet the obligations in case of large-scale disasters will be a challenging task. Conclusion The role of insurance business has been growing importance in financial intermediation, which has received less attention than bank and stock markets.

The ultimate goal of insurance sector is to provide security to insurance industry according to national need by protecting all classes of the society from natural and social risks while embracing the globally accepted insurance norms. The role of insurance sector in the economic development of a nation is significant and multifaceted. It contributes to the economic development by generating employment opportunities, mobilizing savings and investment, strengthening and stabilizing the financial system, helping recovery from crisis for both individuals and businesses, and mitigating the risk associated with agriculture and helping the economy develop international trust.

The contribution of insurance sector in the GDP of 2021-2022 was 3.67% and it is expected that the increasing trend is going to continue. Although the current situation and expansion of the insurance sector seems to be satisfactory, the practice of automatically providing property and life insurance has not yet increased in Nepal. For this, it is necessary to create an environment of mutual trust and coordination among all stakeholders by making the insurance transaction scientific and transparent.

To unleash the full potential of insurance industry Nepal Government, Nepal Insurance Authority and the insurer should focus on implementing policies that facilitates the penetration of insurance in primary, secondary and tertiary sector of the economy for the economic development. The adoption of rapidly changing technologies in the digital landscape to improve the operational efficiency, customer service and overall competitiveness another aspect that will determine the fate of insurance industry.

References

PAN, G. and SU C. (2012). The Relationship between Insurance Development and Economic Growth: A Cross- Region Study for China, China International Conference on Insurance and Risk Management

Pant, S., & KC, F. B. (2018). Contribution of Insurance in Economic Growth of Nepal. Journal of Advanced Academic Research, 4(1), 99–110. https://doi.org/10.3126/jaar. v4i1.19523

M. Subba Rao, R. S. (2013). Contribution of insurance sector to growth and development of the Indian economy. IOSR. Journal of Business and Management (IOSR-JBM), 7 (4), 45-52.

Ministry of Finance (2012). Economic Survey, 2022/23. Kathmandu

Nepal Insurance Authority, Monthly statistics, 2022 July and 2023 July

Nepal Insurance Authority Annual Report 2022

(Bikram Thapa is continuing his studies at Kathmandu University, School of Management. This Article published on NRB-Samachar-69th-Anniversary-Issue)

![$adHeader[0]['title']](https://bfisnews.com/images/bigyapan/1760080292_64756700.gif)

प्रतिक्रिया