Unraveling the Enigma of Seigniorage: A Brief Analysis, Article of Aditya Pokhrel

- Aditya Pokhrel

- 2024 May 01 06:18

Kathmandu. Concept Seigniorage, which is the difference between the cost of creating money and its face value, is the money that the government makes from the printing of currency (Blanchard & Johnson, 2012). In essence, it's the money made from having the ability to create money. According to Mishkin and Eakins (2015), governments generally issue currency or manufacture coins to generate seigniorage revenue. Conversely, inflation refers to the gradual rise in the average price of goods and services within an economy over a period of time (Mankiw, 2014). The ability of customers to purchase goods and services is impacted by this decline in the purchasing power of money.

The connection between seigniorage and inflation can be understood through several avenues. Initially, when governments augment the money supply by printing additional currency, they enhance seigniorage earnings. Nonetheless, if this enlargement of the money supply exceeds the rate of growth in goods and services, it generates an excess of money relative to goods, which in turn contributes to inflationary pressures (Blanchard & Johnson, 2012).

Perceptions of future inflation can significantly influence seigniorage dynamics. Should individuals anticipate higher inflation rates, they might demand more currency in the present, prompting governments to increase currency production to meet this demand. This, in turn, can exacerbate inflation (Mankiw, 2014). Moreover, governments frequently resort to seigniorage to fund their expenditures. Nevertheless, if they excessively print money to cover these expenses without corresponding increases in production, it can disrupt the balance between money supply and demand, resulting in inflation (Mishkin & Eakins, 2015). Central banks play a critical role in inflation management through their monetary policy tools. Through the adjustment of interest rates and the regulation of the money supply, central banks can exert influence on the inflation rate.

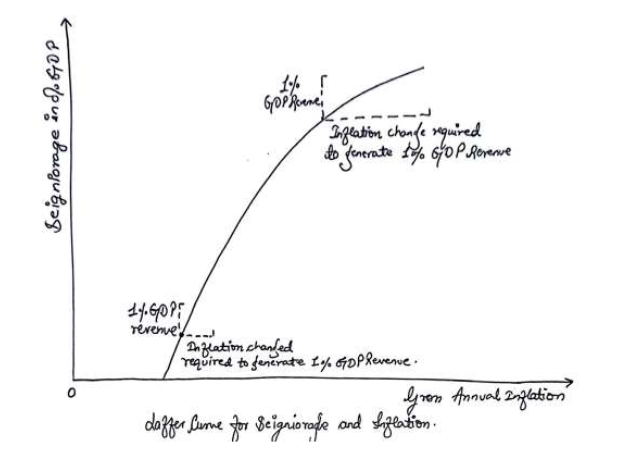

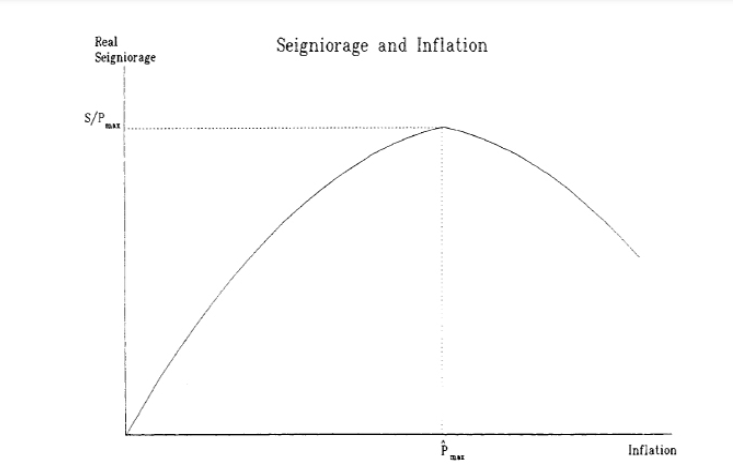

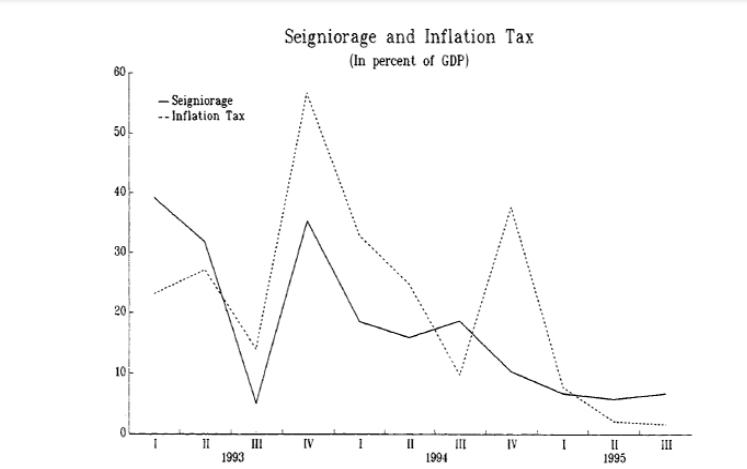

Central bank decisions regarding monetary policy can, therefore, impact seigniorage dynamics (Blanchard & Johnson, 2012). Consequently, the actions and policies of central banks directly shape the relationship between seigniorage and inflation, ultimately shaping the broader economic landscape. Dmitriev & Kersting (2016) considered the relationship between seigniorage and inflation using the analogy of the Laffer curve, as illustrated in Figure presented below.

In this graphical representation, the level of gross inflation is plotted on the horizontal axis, while seigniorage revenue is represented on the vertical axis. As we observe the curve, we notice an interesting pattern: initially, as inflation increases, seigniorage revenue also tends to rise. This relationship reflects the fact that when inflation is low, a moderate increase in the money supply (and hence inflation) can lead to a substantial increase in seigniorage revenue. However, as we move along the curve towards higher levels of inflation, we encounter a point where further increases in inflation result in diminishing returns in terms of seigniorage revenue. This is depicted by the flattening out of the Laffer curve at higher levels of inflation.

In practical terms, this means that when inflation is already high, obtaining an additional percent of GDP in seigniorage revenue requires a disproportionately larger increase in inflation. In other words, the effectiveness of using inflation as a means to generate seigniorage revenue diminishes as inflation reaches higher levels. This insight from the Laffer curve highlights the trade-off involved in using inflation as a tool to increase seigniorage revenue. While moderate inflation may initially lead to higher seigniorage revenue, there comes a point where further inflation becomes counterproductive, resulting in diminishing returns and potential adverse effects on the economy.

The Laffer curve for seigniorage and inflation illustrates how the relationship between these two variables changes as inflation levels vary. Understanding this relationship is crucial for policymakers in navigating the tradeoffs involved in monetary policy decisions related to seigniorage and inflation.

In Nepal, seigniorage revenue is generated primarily through the issuance of currency by the central bank, which is the Nepal Rastra Bank (NRB). When the NRB increases the money supply by printing more currency, it generates seigniorage revenue for the government.

This revenue can be used to finance government expenditures, including infrastructure projects, social welfare programs, and administrative expenses. However, if the expansion of the money supply in Nepal outpaces the growth rate of goods and services in the economy, it can lead to inflationary pressures (Ghimire, 2020). This is particularly relevant in Nepal, where the economy is characterized by various factors that can exacerbate inflation, such as supply chain disruptions, import dependence, and fluctuations in agricultural production. Moreover, expectations about future inflation can also influence seigniorage dynamics in Nepal.

If individuals anticipate higher inflation rates, they may seek to hold more cash as a hedge against inflation, leading to increased demand for currency. In response to this increased demand, the NRB may opt to print more currency, thereby boosting seigniorage revenue. However, if not managed carefully, this can contribute to further inflationary pressures. Nepal has experienced challenges related to fiscal deficits and government spending. In some instances, the government may resort to excessive printing of money to finance its expenditures, leading to an imbalance between the money supply and demand for goods and services. This can contribute to inflationary pressures in the economy.

In addressing these challenges, the Nepal Rastra Bank plays a crucial role in managing inflation through its monetary policy tools. By adjusting interest rates, open market operations, and reserve requirements, the NRB can influence the money supply and inflationary pressures in the economy (World Bank, 2020). Additionally, the NRB's decisions regarding monetary policy can have implications for seigniorage revenue and its impact on inflation dynamics in Nepal. Overall, the relationship between seigniorage and inflation in Nepal underscores the importance of prudent monetary and fiscal policies to maintain macroeconomic stability and mitigate inflationary pressures while ensuring sustainable revenue generation for the government.

RBC and Seigniorage

Froyen (2013) defines that the Seigniorage, the revenue a government earns from issuing currency, and real business cycles (RBC), which explain economic fluctuations driven by factors like technology shocks, may seem unrelated.

However, seigniorage can impact RBC theory in various ways. Essentially, seigniorage reflects the profit made by a government from creating money, which can fund government spending or initiatives. In contrast, RBC theory suggests that economic ups and downs stem from real factors like changes in technology, not just monetary issues. Despite this difference, seigniorage intersects with RBC theory notably in monetary policy's impact on real economic activity. Seigniorage revenue gives governments funds to enact monetary policies. For example, increasing the money supply can stimulate short-term economic growth, while reducing it can slow growth. How governments use seigniorage revenue affects real economic factors. If invested wisely in areas like infrastructure or education, it can boost long-term productivity and growth. Conversely, if used for excessive spending without improving productivity, it may lead to inflation and misallocation of resources.

Additionally, seigniorage influences expectations about future inflation and economic stability, impacting consumer and investor decisions.

High seigniorage levels or fiscal irresponsibility can erode confidence in the currency, leading to adverse effects like capital flight and currency depreciation. While seigniorage and RBC theory operate in different economic spheres, they intersect through monetary policy, fiscal management, and expectations. Seigniorage revenue can affect real economic variables such as output and productivity through its influence on policy and expectations. Understanding these connections is crucial for crafting effective policies to foster economic stability and growth.

Linking with Inflation

Blanchard and Fischer (2009) suggested that incorporating money directly into the utility function offers a simpler approach to navigating the complexities of the cash-in-advance constraint. However, there are instances where a more straightforward method is required, necessitating the explicit specification of the demand for money function. This more streamlined approach has proven beneficial, especially in comprehending the intricate interplay between seigniorage, deficits, and inflation.

For instance, let's imagine a scenario where a government seeks to bolster its revenue through seigniorage, which represents the profit gained by the government from issuing currency. Traditionally, the rate of money growth has been considered predetermined, resulting in a certain level of government revenue from money creation. This revenue, known as seigniorage, serves as a significant income source for governments, contributing approximately 0.5 percent of GNP in low-inflation industrialized economies.

However, in economies characterized by high inflation rates, seigniorage can constitute a considerably larger share of government revenue. In extreme cases, such as hyperinflation scenarios, money printing might even become the sole source of government revenue, underscoring the pivotal role of seigniorage in fiscal management. Within this context, two fundamental questions arise. Firstly, what is the extent of revenue that a government can generate from money creation? Secondly, can efforts by the government to garner seigniorage to finance an excessively large budget deficit lead to hyperinflation? These questions underscore the delicate balance that governments must strike between revenue generation and inflation management.

To further illustrate, let's consider a hypothetical situation where a government opts to boost seigniorage revenue by increasing currency printing to cover its budget deficit. Initially, this may result in an uptick in government revenue due to the seigniorage generated from the additional money supply. However, if the rate of money growth surpasses the rate of economic expansion, it could lead to an excess of money relative to goods and services, ultimately triggering inflationary pressures. This highlights the potential tradeoff between short-term revenue gains through seigniorage and the long-term risks of inflation.

Given our focus on contexts with high inflation rates, we simplify our analysis by assuming that real variables change slowly compared to the price level, allowing us to treat them as roughly constant for analytical purposes. This simplification facilitates a more effective examination of the relationship between seigniorage, deficits, and inflation, offering valuable insights into the dynamics of monetary policy and fiscal management. If we inspect in the case of Nepal, the government's reliance on seigniorage as a revenue source is significant.

With limited alternative revenue streams, seigniorage plays a crucial role in financing government expenditures, including infrastructure projects and social welfare programs. In an economy where fiscal deficits are common, seigniorage can serve as a means to bridge the gap between government revenue and expenditure. However, the excessive printing of money to finance budget deficits can lead to inflationary pressures in Nepal. For example, if the government increases seigniorage revenue by printing more currency to cover its budget deficit, it may initially boost government revenue.

However, if the rate of money growth exceeds the rate of economic expansion, it can lead to an oversupply of money relative to goods and services, ultimately fueling inflation. Nepal's high inflation rates exacerbate the reliance on seigniorage as a revenue source. In economies characterized by high inflation, such as Nepal, seigniorage can constitute a substantially larger portion of government revenue compared to low-inflation industrialized economies. The Nepalese government thus faces a delicate balance between generating revenue through seigniorage and managing inflationary pressures.

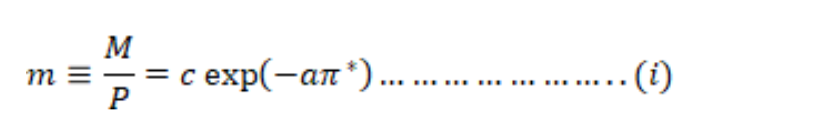

Prudent fiscal and monetary policies are crucial to strike the right balance and ensure macroeconomic stability. By understanding the dynamics of seigniorage, deficits, and inflation, policymakers in Nepal can make informed decisions to navigate these challenges effectively. The core framework comprises two equations: one detailing the need for money and the other outlining expectation formation. Originating from Cagan in 1956, this model delineates the demand for money as follows:

In this formulation, represents a constant term, while stands for the expected inflation rate. A higher expected inflation rate corresponds to a diminished demand for real money balances. Implicit in this framework are two critical assumptions. Firstly, output is considered constant and hence incorporated into the constant term.

Secondly, the real interest rate remains constant and is also encompassed within the constant term. This elucidates why the equation includes the expected inflation rate rather than the nominal interest rate. The primary justification for adopting this functional form lies in its convenience, although it appears to align with data from hyperinflationary contexts. In an equilibrium scenario, the real money stock must equate to the money demand, rendering equation … (i) interpretable as an equilibrium equation (Blanchard and Fischer, 2009). The inflation so as linked with seigniorage, which refers to the revenue a government gains from issuing currency, manifests through various channels according to Zambrano (2013) analysis.

These channels encompass currency devaluation, open market operations, and direct financing and monetary transfers. Currency devaluation refers to a decrease in the value of the domestic currency compared to foreign currencies. When this happens, the government can benefit in several ways. Increased fiscal contributions come from state-owned enterprises, especially the country's main oil

company, which contribute more revenue to the government's coffers when the domestic currency is devalued. This is because their exports become more profitable due to the weakened currency. Additionally, fluctuations in the exchange rate can result in profits for the Central Bank. When the domestic currency depreciates, the Central Bank can benefit from buying foreign currency at lower rates and later selling it when the currency value rises again.

Open market operations involve the government issuing debt in the local currency and selling it to financial institutions. The Central Bank, acting on behalf of the government, purchases these securities using newly created currency. Government debt issuance occurs when the government borrows money by issuing debt securities, such as Domestic Public Notes (DPNs), to financial institutions. The Central Bank's role as the government's fiscal agent involves buying these debt securities using newly created currency, thereby increasing the money supply in the economy.

Furthermore, the Central Bank earns profits from the interest on these securities, which are later transferred back to the government. Direct financing and monetary transfers involve the Central Bank directly financing the government and other public entities involved in activities that have fiscal implications. This includes the country's public oil company, which plays a significant role in financing operations. The financing provided by the Central Bank contributes to the expansion of the monetary base, which includes the amount of currency in circulation and bank reserves.

However, transfers made without corresponding assets directly affect the Central Bank's equity, potentially impacting its financial stability and ability to carry out monetary policy effectively. Linking with the Exchange Rate Seigniorage, a cornerstone concept in macroeconomics, denotes the revenue accrued by a government from the issuance of its currency. This revenue stream carries substantial implications for a nation's monetary policies and its interface with exchange rates.

This memorandum delves into the intricate connection between seigniorage and exchange rates, exploring diverse dimensions and ramifications. Seigniorage wields a significant influence on exchange rates via multiple mechanisms. When a government opts to augment seigniorage by expanding the money supply, it risks instigating inflationary pressures within the economy. This inflationary tendency may, in turn, precipitate a depreciation of the domestic currency vis-à-vis other currencies, thereby affecting exchange rates (Friedman, 1977).

Conversely, a decrease in seigniorage or the implementation of contractionary monetary measures aimed at quelling inflation could fortify the currency, resulting in an appreciation of exchange rates (Blinder, 1981). Conversely, the dynamics of exchange rates can also impact a nation's seigniorage earnings. A robust currency typically attracts foreign investment, offering enhanced purchasing power to investors from abroad. This surge in foreign investment has the potential to augment a nation's seigniorage revenues (Obstfeld & Rogoff, 1996).

Conversely, a weakened currency might dissuade foreign investors, leading to a decline in seigniorage earnings (Edison & Melvin, 1990). The nexus between seigniorage and exchange rates carries profound implications for economic stability and policy formulation. Exchange rate fluctuations stemming from seigniorage dynamics can profoundly impact a nation's trade balance, inflation levels, and overall economic competitiveness (Mussa, 1986). Consequently, governments must judiciously manage seigniorage to uphold exchange rate stability and foster sustainable economic growth (De Grauwe & Grimaldi, 2006). In response to the interplay between seigniorage and exchange rates, policymakers must adopt a nuanced approach. Monetary authorities may need to strike a delicate balance between maximizing seigniorage revenues and ensuring exchange rate stability.

This may entail implementing monetary policies that temper inflationary pressures while simultaneously bolstering exchange rate stability and economic growth. Additionally, policymakers should factor in the potential trade-offs between short-term seigniorage gains and long-term economic stability when devising monetary policy strategies. The relationship between seigniorage and exchange rates is intricate and multifaceted, with far-reaching implications across various facets of economic policy and stability. Grasping and effectively managing this relationship are imperative for policymakers in navigating the complexities of monetary policy, exchange rate management, and overall economic stability.

Linking with International Trade The significance of seigniorage in the realm of international trade captivates the attention of economists, policymakers, and market participants alike. Seigniorage, the revenue derived from currency issuance, exerts multifaceted impacts on exchange rates, trade balances, and inflation rates, contingent upon specific contexts and prevailing conditions. Firstly, seigniorage can exert influence on a currency's exchange rate. When a government or central bank augments the money supply, it may precipitate a depreciation of the currency, as increased money circulation competes for relatively scarce goods and services. Consequently, this depreciation renders exports more competitive by making them less expensive for foreign purchasers, while simultaneously elevating the cost of imports, necessitating more domestic currency for procurement.

Nonetheless, this impact is not linear, as other factors such as interest rates, political stability, and market sentiment interplay with seigniorage in shaping exchange rates. Secondly, seigniorage can impact a nation's trade balance. If a country garners more seigniorage from exporting goods and services than it expends on imports, it can yield a favorable effect on its current account balance, delineating the net flow of goods, services, and investments.

Nevertheless, the efficacy of this effect may be tempered if the country's imports are integral for its economic and societal advancement, or if its exports encounter obstacles or rivalry from other nations. Thirdly, seigniorage can wield influence over a country's inflation rate. Should a government or central bank excessively expand the money supply, it may precipitate a surge in prices as the value of individual currency units diminishes.

This inflationary trend erodes the purchasing power of savers and consumers, potentially diminishing the appeal of the currency for foreign investors. Nevertheless, this impact may be counteracted by factors such as productivity enhancement, competitive forces, and fiscal prudence. For instance, the United States accrues substantial seigniorage from its issuance of the US dollar, which serves as the predominant reserve currency globally.

This seigniorage empowers the US to fund its budgetary and trade deficits, while also furnishing liquidity and stability to the global financial system. However, this reliance on seigniorage also exposes the US to risks such as inflationary pressures, currency conflicts, and geopolitical tensions. Hence, the role of seigniorage in international trade emerges as a complex and dynamic phenomenon necessitating meticulous scrutiny and adept management (Faster Capital, 2024). Nepal's Case Seigniorage bears notable implications for Nepal's economy, considering its distinct socio-economic landscape and developmental hurdles. Initially, seigniorage furnishes Nepal's monetary authorities with a measure of flexibility in implementing monetary policies, chiefly concerning liquidity management and the bolstering of economic growth. Given constrained fiscal resources, seigniorage earnings can complement government budgets, offering relief from financial constraints and aiding in funding crucial developmental endeavors (Nepal Rastra Bank, 2020).

Furthermore, in Nepal, where remittances form a substantial portion of the economy and foreign exchange reserves hold pivotal significance in currency stabilization, seigniorage assumes a role in exchange rate regulation. Through its influence on the money supply and financial system liquidity, seigniorage indirectly impacts exchange rate stability (Tamrakar, 2016). However, judicious oversight is imperative to avert adverse repercussions on inflation and external competitiveness.

Moreover, effective seigniorage management proves critical in curbing inflation and upholding price stability within Nepal. Although seigniorage may offer transient fiscal respite, excessive currency issuance can instigate inflationary pressures, particularly in Nepal's import-reliant economy (Poudel & Luintel, 2020). Hence, the Nepal Rastra Bank must delicately balance seigniorage generation with inflation mitigation to safeguard purchasing power and macroeconomic equilibrium. Additionally, seigniorage exerts influence on Nepal's trade balance and external resilience by impacting exchange rates and export competitiveness.

While a devalued currency stemming from seigniorage might enhance export viability, it could concurrently escalate import expenses and trade deficits if domestic production capacities remain inadequate (Sharma, 2017). Hence, Nepal should concentrate on augmenting export diversity and productivity to leverage advantages derived from seigniorageinduced exchange rate dynamics. Lastly, harnessing seigniorage revenues for sustainable development and poverty alleviation stands as a paramount objective for Nepal's enduring prosperity. Investments in education, healthcare, and infrastructure, funded by seigniorage, can foster human capital development and augment productive capacities, thereby laying the groundwork for inclusive growth (World Bank, 2020).

Nonetheless, ensuring transparency, accountability, and efficient resource allocation remains imperative to optimize the developmental impact of seigniorage revenues. Conclusions In macroeconomics, seigniorage, the revenue earned by governments from issuing currency, is pivotal. It denotes the profit made from creating money and impacts inflation rates, affecting the value of money over time. Governments increase the money supply to generate seigniorage revenue, but if this growth outpaces goods and services, it can lead to inflation. Expectations about future inflation influence seigniorage dynamics, and central banks play a crucial role in managing inflation through monetary policy tools. The relationship between seigniorage, deficits, and inflation is complex.

While governments may increase seigniorage revenue to fund deficits, excessive money printing can fuel inflation. This balance is particularly crucial in high-inflation economies, where seigniorage forms a significant part of government revenue. Prudent fiscal and monetary policies are vital to maintain macroeconomic stability. In Nepal, seigniorage funds essential government expenditures, but excessive money printing can lead to inflation, especially in an import-dependent economy. The Nepal Rastra Bank must carefully manage seigniorage to balance inflation and economic growth. Effective management ensures price stability and sustainable revenue generation. Seigniorage also affects Nepal's trade balance and external resilience by influencing exchange rates and export competitiveness. While a devalued currency may boost exports, it can increase import costs and trade deficits. Nepal should focus on enhancing export diversity and productivity to leverage advantages from seigniorage-induced exchange rate dynamics. In conclusion, understanding the complex relationship between seigniorage and inflation is crucial for policymakers. Prudent fiscal and monetary policies are necessary in Nepal to balance revenue generation through seigniorage with managing inflation, ensuring sustainable economic growth and prosperity.

(Aditya Pokhrel is Assistant Director of Nepal Rastra Bank. Source: NRB-Samachar-69th-Anniversary-Issue.pdf )

![$adHeader[0]['title']](https://bfisnews.com/images/bigyapan/1760080292_64756700.gif)

प्रतिक्रिया